Providers in the health and aged care industry continue to face challenges, including frequent policy changes, ongoing shortages of skilled workers needed to support complex care models for residents, and often siloed and aging back-office systems, to name a few.

Many of these organisations have diverse operations, and Financial Planning and Analysis (FP&A) play a central role in ensuring strong financial management and stability. To do so, finance leaders must be equipped with the processes and tools to ensure their forecasting is dynamic and agile, scenario planning is robust and comprehensive, and that they can quickly report and analyse results.

We hosted a webinar for finance leaders, discussing challenges and opportunities in the Health and Aged Care sector.

Watch the webinar here or read below for a summary.

Healthcare and Aged Care industry challenges

A few years ago, Australia spent $24 billion on healthcare – just over 10% of GDP. We are all living longer, many with chronic health conditions. This contributes to some of the challenges the Health and Aged Care industries are facing include workforce shortages, regulatory and compliance burdens, and maintaining funding and financial sustainability. Furthermore, the industry tends to have low digital maturity.

To add further on-the-ground experience and insights, we were joined by guest speakers and clients, Zane Ali, CFO at Infinite Care, and Merrin Nancarrow, CFO at ECH.

Zane added that they have the challenge of sourcing and retaining good quality talent that can move in an agile way to handle the different conflicting priorities that can come in the sector. Merrin said a current challenge is the new Aged Care Act commencing 1st July 2025 in Australia. A lot of lead time is needed to really be prepared and test systems and understand what process shifts will come from this change. Having Workday Adaptive Planning (their Financial Planning and Analysis system) has helped them run multiple scenarios easily and understand the impacts better.

The role of finance – and spreadsheets

Despite the complexities of the industry, many organisations are still managing their finances using manual processes based on spreadsheets. This can be limiting – think data siloes, disconnected planning activities, version control issues, long planning systems and the inability to pivot quickly in the face of changing circumstances.

This makes it harder for finance leaders to truly play their role, which includes financial strategy and planning, workforce / capacity planning, revenue management and cost management, and regulatory compliance and reporting.

As CFOs, Merrin and Zane quickly realised that to be able to do all this and do it well, they needed to get off spreadsheets. They needed to have accuracy, and the ability to consolidate quickly and have a collaborative process. This would enable quicker scenario analysis and decision making.

The power of modern FP&A

The solution that Merrin and Zane turned to was Workday Adaptive Planning. As a cloud-based, modern FP&A platform, it helps them align planning with operational realities, and supercharge business agility.

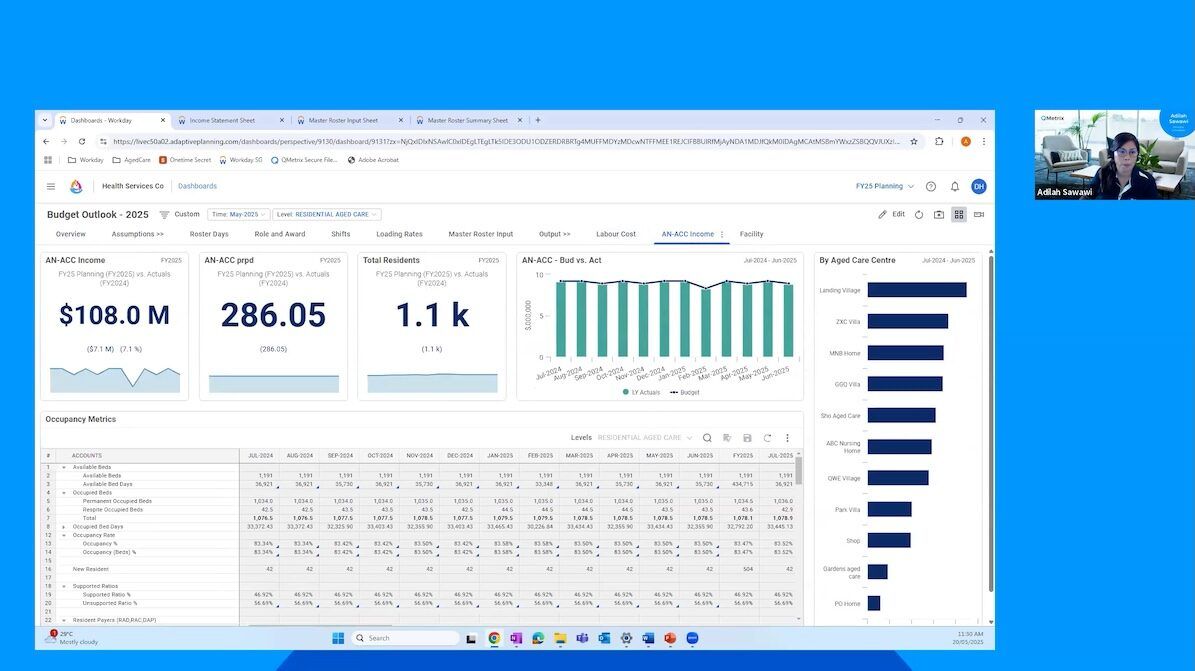

During the webinar, Principal Consultant Adilah Sawawi, provided an overview into planning, consolidation, and reports within Workday Adaptive Planning. She also demonstrated a high level aged care planning model, factoring in available dates, occupancy percentages, resident mix, expense drivers, as well as a direct labour planning model. You can watch this at 34 minutes in the video.

For Zane, once Workday Adaptive Planning was implemented, some of the obvious benefits were the shortened budget preparation process and increased accuracy. He was also pleasantly surprised at how the system is quite intuitive, and that they were able to deliver 3-way financial statements in the first phase of the project.

Zane said, “The biggest thing that contributed to our successful delivery – which was ahead of time and budget – was having well-articulated data structures and working with QMetrix to do the implementation. Being able to articulate what you need, getting teams involved and well versed in the software, and having good project management methodology and appropriate resourcing are also important”. (Read the Infinite Care case study here.)

Merrin said, “After implementing Workday Adaptive Planning, we went from a 4-month budget timeline to about 2 months. So there was significant time back in my finance team’s calendars in terms of being able to provide value add and insights back into the organisation.” She also said the system was intuitive and the business picked it up surprisingly fast – plus, it has generated better conversations.

When asked about advice for implementation, Merrin said internal planning should be complete before kicking off the project, as it would help with streamlining and timelines.

Both Zane and Merrin see this as a journey. While their capabilities have grown with Workday Adaptive Planning in their toolkit, they are looking forward to doing things better such as with forecasts, implementing AI and ML, and integrating to new technology in their own organisations.

Key takeaways for finance leaders

To sum up, the needs in the health and aged care space are complex, and finance leaders have a key role to play in mitigating these. Excel is not enough to support these well; however, modern FP&A tools can help bring agility, deal with compliance aspects, and provide strategic foresight for the organisation.

You can start small, and build on it to set your organisation up for success and bring them into the future.

At QMetrix, we have worked with many health and aged care organisations including BassCare, AnglicareSA, Carinity, cohealth, Baptist Care, Northern Health, ECH, Infinite Care and the Royal Freemasons’ Benevolent Institution. Looking to modernise your FP&A processes and tools?

- Learn how we work with Healthcare finance teams

- Learn how we work with Aged Care finance teams

- Contact us to discuss solutions or watch a demo

Related Articles

Financial and strategic planning for aged care organisations

Read about the challenges in aged care and the role finance plays to mitigate financial risks, ensure compliance, and enhance overall efficiency.

Infinite Care case study: Infinite possibilities with Workday Adaptive Planning

Learn how Australian residential aged care provider Infinite Care implemented Workday Adaptive Planning to enhance their budgeting, forecasting and planning.