What is the Return on Investment for a Planning Solution?

What investment does a typical business make annually when completing their budgeting and forecasting cycles using Excel?

For medium sized businesses that do annual budget and monthly forecast cycles in Excel and have a dozen people involved, the investment of labour time in the process could well be 1.7 FTEs (Full Time Equivalents) per annum.

But what if you could slash your planning cycle times by 90%? You might well gain $150,000 in efficiency dividends annually based on the cost of time spent by highly paid labour resources on planning cycles. If you consider the opportunity cost of these labour resources not spending time on other ‘value add’ activities, the savings could well be higher.

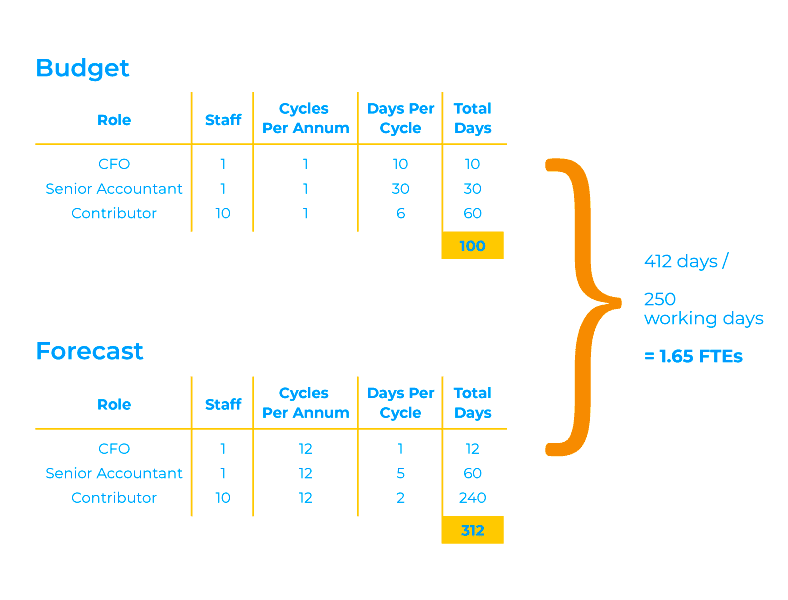

As an example, let’s calculate planning cycle FTEs for your organisation based on the model below – remember, most tend to significantly underestimate the time spent by all personnel on their businesses planning cycles.

This is how we calculated 1.7 FTEs – based on 1 budget cycle and 12 forecast cycles every year, with up to a dozen contributors:

It is proven that by adopting best of breed tools, an organisation can achieve at least a 50% reduction in time ($85k) through improved efficiency and better processes. In some cases, this reduction might be as high as 90% ($150k). Analysing the value proposition based on staff time investment alone is clear enough, but what value is placed on other benefits such as these?

- Improved accuracy through better collaboration and elimination of errors

- The benefit of more frequent planning cycles due to a less onerous process

- Finance and non-finance staff being able to focus on productive and value-adding activities

Even ignoring these benefits, the ROI is always less than 12 months and could be as little as 3 months for some organisations. It is such a compelling business case, yet many organisations continue to experience Excel hell month in, month out.

Most contributors loath the forecasting cycle predominantly because the process is mired with manual and time consuming tasks that consume inordinate amounts of time. As finance people, we don’t blame them for that.

Yet, we can make a difference. Many budget managers avoid moving away from spreadsheets to undertake planning tasks, because they believe they lose visibility and control over the process, surrendering it to IT people, or worse still, external consultants.

This may have been true 10 years ago, but today there are some outstanding finance-friendly solutions that can deliver the benefits of a systemised solution beyond the Excel spreadsheet.

These solutions provide the transparency and customisability for the finance team to independently alter their models to suit their ever-changing business over time. For example:

- Creating a new driver-based model for an expense or revenue item that has become more material in the Profit and Loss due to a new business initiative

- Remapping the organisational hierarchy by reassigning cost centres to a new department or division – and seeing your historical budgets and actuals stay in sync with the new structure

- Adding a new business unit to your planning model for easy integration or to run scenarios analysing the financial impact of the new acquisition

It might sound too good to be true, but we assure you – with the right technology and solution, it is possible.

Is your finance team spending too much time on spreadsheets and looking for a better way to budget, forecast and plan? QMetrix works with organisations across Australia to strategise and implement corporate Budgeting and Planning solutions.

We’re happy to discuss your current budgeting and planning challenges, and see how we might be able to help. Let’s chat.

This post was originally published on 15 May 2014 and updated since.