The professional services sector covers a wide range of professions, including accounting, legal, consulting, engineering, IT, scientific and technical services. It is one of the largest industry contributors to the Australian economy – employing over 1.3 million people, representing 9% of the workforce, and generating revenues in the vicinity of $360 billion across Australia and New Zealand.

Increasing competition in this industry means focusing on growing business confidence and capital expenditure. When it comes to Financial Planning & Analysis (FP&A), those in professional services must ensure their organisation can navigate multiple challenges at any one time, and back-office activities must be lean and efficient despite numerous – and often disparate – systems.

We hosted a webinar for finance leaders in the professional services industry, discussing these unique challenges, as well as the current opportunities and processes that are reshaping the role of finance. You can watch the webinar recording below.

Professional Business Services: A dynamic and competitive landscape

There are many sub-sectors that fall under professional services which are subject to different operating conditions. Whilst many have made their mark offering niche skills and capability, market differentiation can be difficult to portray, and firms need to articulate their unique value proposition effectively.

Depending on the sub-sector they operate in, some organisations have guaranteed demand, but struggle with having the supply of skills to satisfy it. Others need to invest significantly in acquiring new customers and revenue sources to maintain consulting margin, while often struggling to hold onto key resources.

Across the whole industry however, there is pressure for timely and critical information.

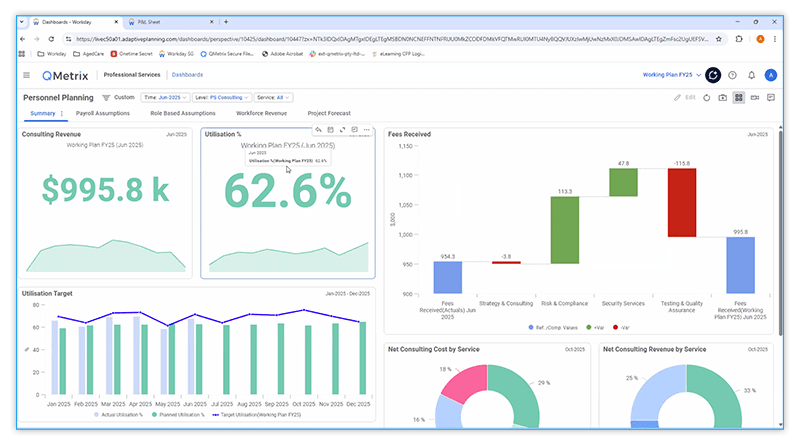

To stay competitive, finance leaders need to tightly connect accurate revenue forecasting with workforce and cost planning, while also keeping skills aligned to demand and maximising utilisation and billing efficiency.

We’ve identified these 3 main areas of challenge for Professional Business Services:

1. Increasing client expectations: Expectations continue to evolve and the demands of a personalised, more value-added service can strain even the higher performing organisations.

2. Maintaining healthy margins: Organisations ride the line between supply and demand; continually having projects with profiles well matched to available skilled resources is important in maintaining utilisation and viable margins over the outlook period.

3. Attracting and retaining talent: Offering attractive compensation packages and opportunities for career growth are keys to staying competitive, and strategies to limit burnout are important.

Shared concerns and key priorities for finance leaders

To add further experience and insights, we were joined by guest speaker and client Tania Amalen (CPA), Finance Manager at Douglas Partners.

Tania shared her some of her biggest concerns and challenges as a finance leader:

- Do we have a good understanding of our cash position?

- Are profits going to convert the way we expect?

- Are our forecasts truly accurate and reliable?

- Do we really understand our numbers, and are we in control of them?

In our conversations with hundreds of finance leaders, we often hear about similar concerns when it comes to managing FP&A.

Spreadsheet dependency: When is it time to move on?

Excel is a popular tool of choice for finance. However, relying on it as the foundation for FP&A can actually hold finance teams back, limit the finance function’s influence and impact on the business, and make cross-department collaboration difficult.

When asked about the factors that led to Douglas Partners’ FP&A transformation, Tania responded that it came down to a few reasons. One was the complex nature of using spreadsheets to oversee 600+ staff – all with various charge rates that differed based on regions and seasons. Individual productivities and costs were difficult to manage, and it was not sustainable.

The finance team were too focused on getting things right in Excel. So much time was spent updating pivot tables and cross-checking data. Scenarios were almost impossible to do because it would take even more spreadsheets, and it was difficult to always track what impacts each change would make.

Modern FP&A transformation means evolving – from reactive to proactive

Over the past decade, the FP&A function has been evolving from one that is reactive, to becoming more proactive. They are in position to be a strategic partner to the CEO and board, with the unique position to supercharge business agility through informed conversations driven by the right numbers and data.

During the webinar we asked attendees what they thought would be the key benefits of modernising their FP&A process. “The ability to do ‘what-if’ scenario planning” was the top choice, followed by “more accurate and reliable revenue forecasts” – and it’s easy to see why.

Quick and seamless scenario planning can assist the executive team in understanding the financial implications of big contract wins or project deferrals. Pairing that with reliable and accurate forecasts to help prepare any potential responses and to mitigate impacts well in advance is a huge benefit.

Prior to implementing Workday Adaptive Planning, Tania admits, “We didn’t have very rich or strategic conversations. We were just trying to finish the budget”. But after working with QMetrix to implement Adaptive Planning, their finance team evolved from being number crunchers to becoming true strategic business partners.

“We did expect some time savings, but we didn’t expect the amount of time we were able to save.” They used to have to start the budget process in January to complete it by June. Now with Adaptive Planning, they can start in March and have it ready by May – moving the focus from getting the spreadsheets right, to having the right conversations.

As seen in this case study with Douglas Partners, the improved budget process also drew greater engagement from managers, who valued being able to see changes in real-time.

How does this all work? Adilah Sawawi, Principal Consultant at QMetrix, demonstrated how these can be achieved in an FP&A solution, using Workday Adaptive Planning as an example. She showcased dashboards, driver-based planning, scenario planning and more for Professional Business Services. You can view the demo in the video at 22:25.

The path forward for finance teams in Professional Business Services

While the professional services sector faces its unique challenges, the industry as a whole is feeling the pressure to adapt to technological change – but digital transformation doesn’t have to be scary.

What’s truly scary is being bogged down by outdated systems and manual processes, forcing you to spend all your valuable time just keeping the ship afloat instead of plotting a course forward.

The benefit of a tool like Adaptive Planning is the scalability – you have the option to start with the basics and build from there, setting your organisation up for success and bringing them into the future.

After the initial implementation project, the value of the Adaptive Planning platform has continued to grow for Douglas Partners’ finance team and the wider business. Tania says, “The first budget cycle was purely to get off Excel. Now with each budget cycle, we’ve been using more functions and getting more out of it”.

At QMetrix we have implemented FP&A solutions for many organisations including Slater & Gordon, CyberCX, Cirka and TTW.

We bring our cross-industry insights, expertise and best practice methodologies to enable your finance team to think differently – and implement planning models that will work for your organisation.

If you’re interested to find out more, let’s chat about your business and needs.

Or if you just need somewhere to start, check out our comprehensive guide to selecting the right FP&A tool that covers features to functionality and cost.

- Discover more of Workday Adaptive Planning in action with an in-depth demo.

- Read Douglas Partners’ case study in more depth

- Learn how Slater & Gordon went from re-forecasting in 1 month to 1 week

Related Articles

Douglas Partners: from number crunchers, to business partners

Here’s how Workday Adaptive Planning enabled Douglas Partners’ finance team turn from number crunchers to business partners.

Financial and strategic planning for professional services

In this whitepaper, we explore the challenges faced by finance teams in professional services. We discuss their role in strategic planning, mitigating risks, and enhancing overall efficiency.