In today’s rapidly evolving business landscape, finance teams play a crucial role in helping organisations stay agile and make informed decisions.

Traditional static annual budgeting has its limitations, making it difficult for businesses to adapt to unexpected changes and capitalise on emerging opportunities.

Rolling forecasts, on the other hand, offer a dynamic and flexible approach that enables finance teams to respond to market fluctuations, identify potential risks, and steer the company towards success.

On this page, learn what high performing finance teams are putting into practice, and discover how rolling forecasts can empower your finance team to navigate an ever-changing landscape and drive business growth. Watch the webinar hosted by Alex Houghton (Practice Manager – CPM) and Kieran Garriga (Principal Consultant) or read on for more insights.

In this article we cover:

- What is a rolling forecast?

- Static vs dynamic: How are rolling forecasts different from traditional forecasts?

- Why are rolling forecasts important?

- How regular should my forecast be?

- Why doesn’t everyone do it?

- Can I use Excel to do rolling forecasts?

- How can a FP&A tool help with rolling forecasts?

- How to start a rolling forecast

What is a rolling forecast?

Keeping up with recent trends, we asked ChatGPT to tell us what a rolling forecast is. Here’s what it said:

“Rolling forecasts are a financial planning and budgeting technique used by businesses to continuously update their financial projections, typically on a regular basis (eg, monthly or quarterly), by replacing the oldest period’s data with the latest actual results and adjusting future forecasts accordingly.

This approach allows organisations to maintain a forward-looking view of their financial performance and adapt to changing circumstances more effectively.”

Let me break it down below.

Static vs dynamic: How are rolling forecasts different from traditional forecasts?

- Rolling forecasts are continuous, unlike a traditional “once-off” forecast. As each month actualises, an additional month of planning is added to the end.

- They leverage the latest actuals, where current data is king.

- It is forward-looking and focusses on what will happen, not what has already happened.

- They allow us to pivot and adapt more effectively.

The key is that rolling forecasts are a living thing. It is always changing and moving, just like how a business always changes. Rolling forecasts can be done as a 12 month planning cycle, or even as a 3 or 5 year plan where projections are continually updated.

Why are rolling forecasts important?

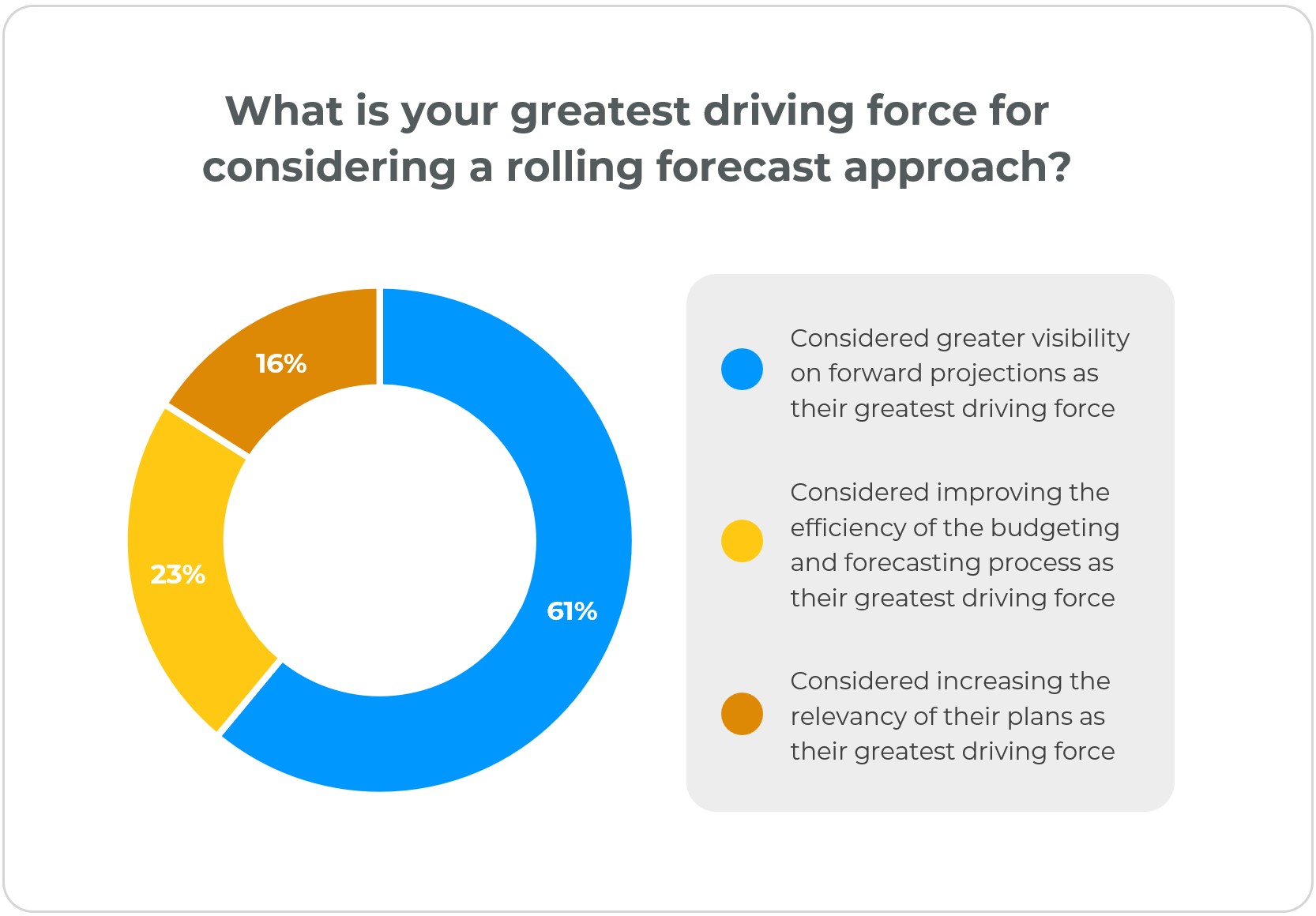

During the webinar we did a poll, asking “What is your greatest driving force for considering a rolling forecast approach?” Here’s how attendees answered.

- 61% considered greater visibility on forward projections as their greatest driving force

- 23% considered improving the efficiency of the budgeting and forecasting process as their greatest driving force

- 16% considered increasing the relevancy of their plans as their greatest driving force

Rolling forecasts definitely help with those points. Compared to static forecasting, rolling forecasts are more relevant, efficient and provide greater visibility on our future projections.

Take the example of buying a new car. The moment that car leaves the dealership, it loses a significant portion of its value. A forecast is the same. As a traditional forecast ages, the numbers move further away from what’s really happening in your business.

A rolling forecast can also improve the accuracy and efficiency of your financial plans. It doesn’t have to be a once-a-year exercise that has a heavy load of input, but not a lot to show by way of an output. Not only can the effort be spread across the year, numbers can also mean something all year long.

Rolling forecasts are also more efficient than a budgeting process. We have seen many companies take 2 – 3 months to create the budget; it can be a painful exercise which repeats itself year after year. With rolling forecasts, you refresh the numbers and can get efficiencies from the exercise rather than it being a drawn-out yearly process.

As for visibility, we know rolling forecasts are forward-looking. They can help us answer the tough questions like when we may run out of cash, or where we could be at risk of falling outside a debt covenant. From there, we can make proactive decisions to navigate uncertainties, optimise resources, adapt to change, stay agile and achieve our goals.

How regular should my forecast be?

A question we often get asked is, “Is there an optimal frequency for a rolling forecast?” Honestly, there is no one answer for this.

If a forecast is done every 6 months, it is not really rolling forecast. It would be leaning more towards a set-and-forget static forecast. A forecast would need to be done at least quarterly for it to have its progressive nature.

If you are in the energy sector where prices change every day, you might need a forecast that is updated daily, weekly or monthly. On the other extreme, if you are in an organisation which has fixed term contracts which don’t have a lot of impact on cashflow, a monthly or quarterly forecast could suffice.

The question to ask yourself here would be: How often should I refresh my forecast to keep it relevant?

Why doesn’t everyone do a rolling forecast?

There are several barriers to achieving rolling forecasts, but it often comes back to people, processes or systems. Some questions to ask yourself are:

- People: Do I have buy-in from management? Do the people in my organisation have the right skills?

- Process: Do my processes enable my team to perform rolling forecasts? Are there too many data inaccuracies, or perhaps not enough time after contending with month-end?

- System: Do I have a dedicated Financial Planning and Analysis (FP&A) tool? How much further can I stretch Excel?

These are also interrelated. For example:

- Are your processes defined enough for people to follow?

- Do you have people with the right skills to use the system(s) in place?

- Does your system align with and complement business processes?

As much as people, processes and systems can be barriers, they can also be enablers. If you think a rolling forecast will benefit your business, how can you put in place the right people, processes and systems to achieve it?

Can I use Excel to do rolling forecasts?

Excel is a great tool. It is very flexible and able to do a lot of modelling. Small teams with just 1 or 2 contributors could manage a rolling forecast in Excel. That’s because you likely have less consolidation and can manage integrity of data more easily.

However, if the business is looking to scale and you want the FP&A process to scale, we recommend looking at a dedicated tool that can scale with you.

So can Excel do a rolling forecast for your organisation? Possibly.

Should you use Excel to do a rolling forecast? In most cases, Excel is probably not enough.

How can a FP&A tool help with rolling forecasts?

Rolling forecasts are all about staying up-to-date and being able to adapt to changes in real-time. A good FP&A tool can make implementing and maintaining a rolling forecast much easier and could be a worthy investment. Beyond that, they often have additional features that can improve the way budgeting, planning and reporting is done.

When you are looking for an FP&A tool to enable rolling forecasts, here are the non-negotiable features and functionality to look out for.

Automated rolling in of actuals

The number one thing is that the tool must have the ability to roll the most recent actuals automatically into the forecast versions. This means you don’t have to manually spend time inputting data every week or month, and can trust the data is always accurate and updated.

Version control

Implementing the rolling forecast process requires a tool that has version control capability. This means it allows finance users to manage versions, create an unlimited number of scenarios, allows for easy comparison of actual versus forecast, all while tracking any changes made for transparency.

Further, the tool should allow versions to be locked to end-users but remain open for finance and power-users to make final submission changes.

Driver-based and multi-dimensional planning capability

To create an efficient rolling forecast process, often the financial outputs (statements) will be driven by operational data such as leads, sales orders, purchase orders, inventory/stock levels and payroll information.

This data is generally multi-dimensional and planned in various ways, depending on the audience. A common multi-dimensional requirement is sales planning by customer (dimension 1) and products (dimension 2). This additional flexibility allows planning at a more granular level that represents the true influences of financial outcomes (ie, product mix, sales price, quantity).

Multi-user collaboration

Organisations that implement rolling forecasts well will have business users contributing to the planning process, directly in the system. This requires the system to allow multiple users to view and edit data in real time.

Further, the results will automatically be reflected in the financial statements to give the office of finance an up-to-date view of the financial impacts of changes made by the business users.

Top-down and bottom-up planning

Some organisations take the approach of using a “top-down” method for updating their rolling forecast, while keeping a traditional “bottom-up” method for budgeting. The best tools in the market allow you to use both methods, meaning you don’t have to compromise on your approach to suit the system.

Continuous time span

Without a continuous time span, a rolling forecast is simply not possible. The system should easily roll periods over, adding the next period required for a rolling forecast.

Intuitive end-user interface

To allow end-users to contribute to the forecasting process directly in the system, it must be easy to use and navigate. Without this, the process will fall back on the finance or business partnering team to make adjustments on behalf of the responsibility centres/managers. This diminishes accountability to the numbers and puts a greater demand on the finance team.

Audit trail capability

While it’s important that users can contribute directly to plans, equally as important is that finance understands what has changed. Taking the direct input away from the finance team means there needs to be an ability to track changes made. Looking for a tool with the ability to quickly see an audit of a change in any cell is critical for long-term success.

Implementation partner

Adapting from static to dynamic (rolling) planning is as much a change management process as it is a system implementation. Working with experts who have successfully delivered these types of process and system improvements is critical to ensuring that the right path and approach is taken towards success.

How to start a rolling forecast

Think you’re ready to start rolling forecasts? Consider the six questions below and see if you have answers to them.

- What data do I need?

Having operational data can help to drive your rolling forecast. Do you need to feed in information from your Point of Sale or CRM system? What data do you need to get it up and running? - What time horizon are you forecasting on and how frequently will you update it?

Will you be forecasting on a 2 year time horizon? Will it be a monthly or quarterly exercise? - What are your assumptions?

Work through the assumptions that would make sense to your unique business. They can be run rates, other drivers or external assumptions like foreign exchange rates that are important to your business.

- Who needs to contribute, and can they do this in a collaborative way?

Would it be the finance team who works with the business to run this, or will this be a collaborative process where users from different departments contribute in real time? What does this mean in terms of change management and upskilling people?

- Do I have a tool that allows multi-user, central data and controls?

Do you have the right tool to implement rolling forecasts and level up your FP&A processes? In the webinar, we gave an example of one of the best tools in the FP&A / Corporate Performance Management space. Have a listen at the 27-minute mark where we demonstrate how rolling forecasts can be done in Workday Adaptive Planning.

- How urgent is the need to change and where does it sit on the priority list?

Is it a nice-to-have, or important to have and could greatly affect business processes and outcomes?

Let’s keep it rolling…

This rounds up our notes about rolling forecasts, why they are important and key considerations for implementation. There’s plenty more detail in how we approach this when working with our clients. If you are keen to learn more, drop us a message or call and we’d be happy to chat.

Meanwhile if you haven’t watched the webinar, there are some Q&A at the webinar’s 42-minute mark to explore. They cover questions including:

- Can FP&A tools do a 3-way budget and forecast?

- How does it work when you don’t have a centralised data warehouse? Can you integrate various systems with the FP&A tool?

- We have department managers who contribute directly to rolling forecasts and plans. When rolling out an FP&A tool such as Workday Adaptive Planning, what has uptake been like in your experience?

Get free finance related insights and practical tips – read articles and watch videos to level up your knowledge

QMetrix has worked with the office of finance for over a decade to deliver Corporate Performance Management solutions

Looking for an FP&A tool?

Check out From Features to Functionality to Cost: A Comprehensive Guide to Selecting the Right FP&A tool