What does financial management and strategic planning look like for not-for-profits?

From deep experience working with not-for-profit organisations including community service organisations, health and disability care providers, charities, membership and sporting associations, and schools, we share the challenges not-for-profits face and how these can be tackled.

Table of Contents

Who or what are not-for-profits?

When most people hear the term not-for-profit (NFP), they immediately think of charities. While charities are almost exclusively NFPs, many other types of organisations can be NFPs including (but not limited to) sporting organisations, churches, professional and business associations, cultural organisations, community health providers, schools and childcare centres.

As this list suggests, NFPs are a large and vitally important part of the economy and society. What sets a NFP apart from other organisations is not actually whether they seek to make a profit (often called a surplus in the NFP world), but where any surplus goes to. For a NFP, a surplus will be used to fund future operations or directed to areas aligned to the mission of the organisation.

For example, the surplus generated by a national sporting organisation is likely to be directed towards grassroots sports clubs and the promotion of their sport among the population.

So, a NFP is not necessarily a charity and can exist in almost any industry. Despite the title “not-for-profit”, these organisations very often seek to make a surplus from their operations to fund growth and strategic initiatives that work towards achieving the mission statement of the organisation in the same way as for-profit organisations.

Despite the title “not-for-profit”, these organisations often seek to make a surplus to support their initiatives.

Does financial management matter for not-for-profits?

If an organisation is “not-for-profit”, does financial management really matter?

Yes! This might not seem obvious at first, but it really matters that NFPs manage their finances as much or more closely than commercial organisations.

Unlike a commercial organisation with an end goal of getting the most profit by minimising costs and maximising revenues (forgive the simplification here, I know Corporate Social Responsibility and stakeholder engagement are becoming more important to commercial organisations), a NFP will seek to maximise their social impact, which can often mean consciously having a higher cost base (we explain more below in “Going above and beyond isn’t cheap”).

What are the typical not-for-profit funding sources?

Often NFPs will receive funding from federal, state or local government, from foundations or from corporations. In almost all occasions, these funding sources require rigorous and detailed reporting back to the funder (often called acquittals) regularly detailing how, when and on what the funds were spent.

The acquittals are often audited by third parties and there are frequently limitations on what can and cannot be spent against specific funding. Meeting these obligations are onerous, but necessary, to ensure ongoing funding.

Reporting of acquittals requires a well-staffed and well-structured finance team, and ensuring that spend is managed as per funder requirements requires strong financial management. If strong financial management is not present, NFPs may spend in areas which the funder has not approved, leading to overspend which cannot be recovered.

To have strong financial management, fit-for-purpose reporting is essential.

A fundamental requirement for strong financial management is fit-for-purpose reporting. While most accountants are locked into using Excel for all their reporting needs, most Excel reporting is one-off and standalone.

In order to support strong financial management, reporting should have version control and the ability to drill into the numbers and get down to the transaction level detail if required. This will require a specialist solution with integration into the GL.

While this may sound like over-investment in the finance area, a well-designed specialist solution will actually provide a positive return on investment through saved time and improved accuracy and timeliness of reporting.

Who pays for overheads and how do you allocate costs?

Overhead – it isn’t 4 letters and it is not on any list of banned words for corporate email servers that we are aware of. But in the NFP world, overhead is like a double 4 letter word!

Overheads are, in fact, the cost of doing business. They are the cost of:

- Having a developed HR function to ensure standards are maintained

- A finance team to ensure costs are spent and recorded appropriately, and staff and suppliers get paid

- An executive team that sets a vision and ensures execution of the vision and long-term sustainability of the organisation

These are all necessary functions and exist in all organisations. But in an NFP, in particular NFPs that are funded by grants, these overheads are often things that donors do not want to pay for and do not see the value in.

As noted above, funding is often received with specific allowed and disallowed expenditure, or limits on the percentage of funding which can be spent in an area, and very often “overhead” costs are limited to a fixed percentage.

There are some ways in which many of the costs which are typically classified as overheads can be attributed directly to a project. One of these is the use of drivers.

NFPs can use drivers to ensure that costs which would otherwise be classified as overheads are allocated out against individuals, projects or cost centres with a robust methodology which should satisfy donor reporting requirements.

There are a few methods not-for-profits can use to allocate costs using drivers, and satisfy donor reporting requirements.

There are a couple of methods of allocating costs using drivers.

The simplest (and least effective) option is to take total overheads and apportion these based on either headcount, FTE or salary cost.

The second option for overhead costs allocation is a little more involved, but actually delivers a much more equitable outcome. It can also easily be explained to donors (existing and potential) and to internal stakeholders.

This method involves taking each cost type, assigning it a relevant driver and allocating it accordingly. For example, IT costs could be allocated per machine, office accommodation costs could be allocated per desk or per utilisation of the office , payroll and HR costs could be allocated by headcount (not FTE because a 0.2 FTE will still need the same attention to their payroll as a full FTE).

The second option allows an organisation to:

- accurately and equitably allocate costs across various activities and locations

- be able to assess the profitability / cost effectiveness of projects and cost centre

- conduct internal and external benchmarking to ensure their operations are efficient

Another methodology for allocating costs which are typically thought of as “overhead” or “corporate” costs is turning a cost centre into a profit centre by charging internal stakeholders for services provided based on externally benchmarked costs.

The profit centre methodology is often used in internal IT teams where tickets are allocated to each task and costs are allocated by time spent or by the type of task completed. This methodology can be difficult and time consuming to maintain and may not be accepted by funders or auditors as valid given that it may involve the over-recovery of internal costs.

Using a fit-for-purpose solution will allow NFPs (and for-profit organisations) to automate their overhead allocations and any other allocations required, simply and easily, by setting up allocation rules once. These will then apply automatically across either a single division or the whole organisation each month.

The allocation methodology must be flexible enough so that it can be changed between versions (ie, actuals, budgets, forecasts) which can support either a change in methodology or scenario analysis.

Importantly, the allocations can then be fully transparent for auditability and traceability, which is extremely important when reporting to the provider of the grant / fund.

Batting for rolling forecast success with SACA

Going above and beyond isn’t cheap

Have you heard of the not-for-profit organisation with the offshore call centre? No?

I’m sure there are some examples out there, but as a general rule, NFPs will most often make their decisions with their mission and community that they serve in mind rather than the “commercial” or “least cost” decision which a commercial organisation might tend to make.

Even if costs are important when weighing up options, it is likely that a NFP will allocate cost with a lesser weighting in their decision-making matrix than a commercial organisation would.

Not-for-profit organisations often make decisions with their mission and community as its primary focus.

In addition to not always choosing the cheapest or most economical option available, a NFP will often choose to “over-service”. Over-servicing can take many forms, but an example would be where ratios of teachers per child or carers per patient are set at a minimum level.

Most commercial operators will use these minimum levels as the basis of their business plans. However, a NFP may seek to sacrifice profitability and instead impose higher teacher or carer numbers than the minimum required in order to achieve a better outcome for the children or patients. This would make their costs higher than a commercial organisation when tendering for the same piece of work.

Staff retention is hard

Like everything else that a NFP does, staffing involves hard choices, particularly when these choices are related to staffing levels and salaries relative to the market.

The government may offer some incentives for people to work in the NFP space, such as the fringe benefit tax benefits (FBT) offered to many NFP workers in Australia which reduces the amount of tax paid on NFP salaries.

However, it can be hard for NFPs to do some of the things talked about above, such as over-service, support their purpose, and still afford to pay staff at the same rates as commercial organisations.

Because of this, salaries are often lower in NFPs, and this requires that staff make a conscious decision to forgo some salary in order to contribute to the organisational mission.

Given that NFPs face pressure to keep overheads low, often functions which are not delivering front line or mission aligned services can be deprioritised and, in many cases, left under resourced. Under resourcing issues can often be exacerbated by low salaries on offer relative to for-profit organisations, which may lead to more high performing staff leaving due to the twin issues of overwork and underpay.

Finance and HR can look at workforce issues to share understanding on how it impacts the organisation’s financial performance, prevent unexpected costs and reduce risk.

While the organisational mission is often a large factor in drawing people into the NFP space, the lower salaries on offer can be the deciding factor in staff leaving the sector.

While there is no simple solution to staff retention, providing staff with the most suitable technology available to enable them to perform their roles to the best of their ability is a fundamental requirement. It is also essential to have a workforce planning strategy with a fit-for-purpose solution to help enable that strategy.

People are central to every business and having the right planning and reporting solution can assist with:

- managing people and processes

- understanding what talent is needed to fulfil business goals (and placing people in the right roles that engage and retain them)

- moving from reactive to proactive staff planning

- identifying future workforce needs to support the organisation’s future direction

How do you finance a not-for-profit?

We have all seen the ads on TV – a smiling banker greets their small business customer at their premises. The handshake (in a time before COVID-19) signifies a loan has been agreed; a loan which will help the business move into new premises or invest into new markets to expand their business.

This is the story of how many businesses grow. They borrow from banks and, if successful, they gain scale, improve efficiencies, grow profitability, repay the loans, and go from strength to strength.

So how does this process work for NFPs? Put simply, rarely. Taking out a loan often requires growth plans. It always requires a plan to repay the loan and this makes loans something with a substantial amount of risk. Risk is not generally something that NFPs are that comfortable with, so loan financing is something that NFPs do less frequently than their for-profit peers.

There is a prevailing expectation on NFPs to live within their means, and in some cases, funding bodies enforce this expectation by requiring organisations seeking funding to demonstrate strong balance sheets and low risk profile.

Is your non-profit organisation able to demonstrate strong balance sheets and low risk profile?

About half of not-for-profit organisations derive a substantial part of their cash incomes (50% or more) from government sources.

Another way NFPs are getting funding is through actively seeking to establish for-profit or commercial ventures which operate independently of the NFP with the purpose of making a profit, which will then be used to support the mission of the NFP. This is usually achieved in a similar field to the NFP, but aimed at a different customer cohort.

For example, a NFP healthcare provider may choose to start a for-profit service for private healthcare patients and use the profits from this enterprise to subsidise their offering to patients who are not able

to afford private healthcare.

The creation of additional entities such as a for-profit entity used to subsidise a NFP can often mean incurring the expense of standing up a new finance team. It will also require a manual consolidation of results from two or more different general ledgers, but this doesn’t have to be the case.

Using a fit-for-purpose solution can bring transactions from multiple entities and multiple ledgers together in one place. It allows, via easy to set up security settings, different teams to plan and report the department, entity or group that they are responsible for.

A not-for-profit getting the right financial insights

Strategic planning for not-for-profits

Additionally, NFPs need to look beyond the current Financial Year and create longer term strategic plans with a multi-year view.

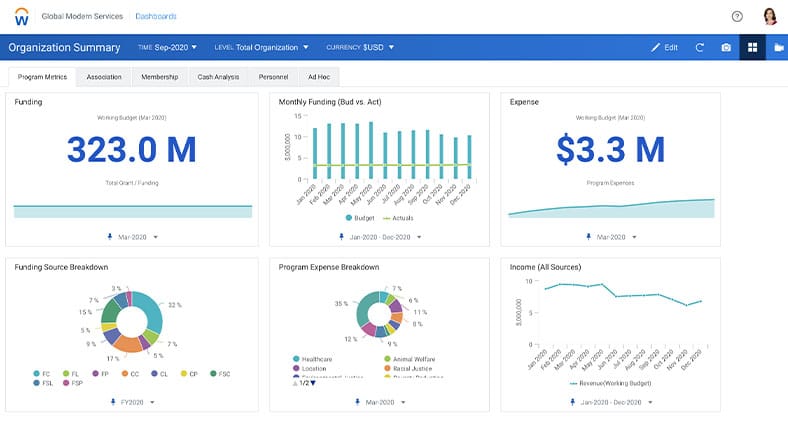

With a fit-for-purpose solution, NFPs can easily undertake long term scenario planning and what-if analyses, applying cost and revenue drivers against various strategic initiatives to understand bottom line impacts of potential actions.

Where do efforts need to be focused? What people need to be recruited? How much funding will it take? Armed with the right information, the leadership team can create an action plan on how to achieve the organisation’s strategic goals.

Having the right information is essential in helping the leadership team create a plan to achieve the organisation’s strategic goals.

When you can undertake data-driven decision making to assist in executing on the NFP’s vision, it brings to the fore the importance of strategic planning for NFPs, as well as the importance of tools that can facilitate the process.

What’s next: Supporting not-for-profits in their mission and growth

Not-for-profits are an essential part of society. Whether a community service organisation, health and disability care provider, charity, school, religious organisation or membership association, their success is essential to ensuring our communities continue to be supported and in fact, thrive.

For not-for-profits to sustain services, make decisions that benefit their mission and community best, and push forward in their vision, there are many areas to consider.

From an FP&A point of view, this includes helping to secure funding, management of overheads and being smart with cost allocations, workforce planning, and having timely access to key financial data and metrics for decision making and future planning, plus satisfying the needs of those providing the funds.

Not-for-profit organisations have many areas to consider including funding, management of overheads, being smart with cost allocations and having timely access to key financial data.

At QMetrix we won’t say we can solve all the issues which impact not-for-profits. But we can certainly help your organisation alleviate some of the pressing issues through technology that allows you to better understand financial results and future plans so you can maximise social impact.

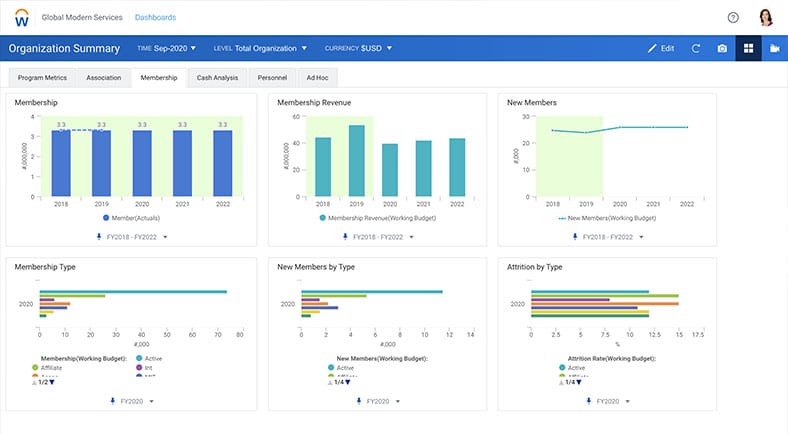

A key solution we work with is Workday Adaptive Planning. As a performance management software platform, it is designed for business users and finance teams to visualise performance, plan effectively and monitor results.

We have deep experience working with not-for-profits including charities, membership and sporting associations, and schools. These include cohealth, World Mosquito Program, Tennis Australia, Royal Australasian College of General Practitioners, Cricket Australia, South Australian Cricket Association, and Royal Australasian College of Surgeons. Click each link to read their case studies.

We will be happy to share how these organisations implemented fit-for-purpose planning technology and the results it delivered for their team and customers / beneficiaries / constituents.