Alternate Calendars And Contra Accounts In Workday Adaptive Planning

Discover how Alternate Calendars allow for different rollup structures and how Contra accounts can help align your Workday Adaptive Planning hierarchy with source systems.

Enterprise Performance Management (EPM), also referred to as Corporate Performance Management involves measuring, analysing and reporting the performance of an organisation. It includes processes of planning, budgeting, forecasting and reporting.

Organisations who practise strong Enterprise Performance Management reap the rewards of truly understanding their business, being able to pivot based on real-time insights, and remaining competitive to drive business success and longevity.

Enterprise Performance Management is not just reporting or what your business intelligence tool can give you. It is much more. The benefits of EPM include:

Discover how Alternate Calendars allow for different rollup structures and how Contra accounts can help align your Workday Adaptive Planning hierarchy with source systems.

[Video] Learn how Microsoft Dynamics 365 and other cloud-based ERP users can get more from their Financial Planning and Analysis capability.

We demonstrate multiple use cases of Virtual Versions in Workday Adaptive Planning and how to set these up for optimal reporting.

Modelled sheets are tabular style sheets which let you perform data entry to drive calculations. Learn how to create a modelled sheet in Workday Adaptive Planning.

Learn how Workday Adaptive Planning enabled Trilogy Funds to better manage their loans, forecast, report and make data-backed decisions.

[Video] The COVID-19 pandemic has been a catalyst for organisations to re-imagine FP&A. Learn about key planning trends that are driving organisational agility and empowering finance teams to drive execution of strategy.

Planning, budgeting and forecasting is an important part of any business. When done poorly, they lose meaning as they becomes outdated and the organisation relies on outdated or incomplete data.

But when done well, it enables finance and the entire business to truly measure, track and deliver performance.

The benefits of strong planning, budgeting and forecasting include:

What does financial management and strategic planning look like for not-for-profits? From deep experience working with not-for-profits we share the challenges they face and how these can be tackled.

Many organisations are now investing in automated solutions to adapt to the changed global business environment. Here are 3 cost-effective tools that can arm CFOs with the automated and flexible capabilities required for competitiveness.

The market will continue to be volatile. And now that we work in a digitalised world, businesses need greater agility than ever. Here are 3 key things organisations must have to optimise business performance in the new market.

QMetrix has worked with organisations across many industries to achieve their Enterprise Performance Management, and Financial Planning and Analysis goals.

Learn about the challenges, solutions and outcomes in these case studies of real businesses like yours.

“Workday Adaptive Planning has fundamentally changes the way we work. It provides a wealth of accurate information quickly. With it we can forecast, see pipeline, and manage our existing portfolio of loans.

The dashboards provide a brilliant overview of everything we need to know.” – Justin Smart, Chief Operation Officer, Trilogy Funds

From the CEO to the operations and marketing teams, everyone relies on key reports to understand how the business is performing and to make decisions on many levels.

Reports with poor data quality from disparate systems result in organisations that are bogged down by too much manual consolidation, poor business intelligence, and decisions based on outdated data.

That’s why implementing best practices in reporting are important. You want to have reports that provide timely, accurate insights in context that will help your business stay agile and able to respond to marketplace changes.

What are the benefits of good reporting?

Workday Adaptive Planning is a leading cloud-based Enterprise Performance Management system that enables organisations to conduct continuous planning, reporting and analysis.

It is rated as a top performer on sites like Gartner, TrustRadius and G2 Crowd based on its features and high customer satisfaction rating.

What are the benefits of Workday Adaptive Planning? With this Enterprise performance management system, your finance team can spend less time on manual data entry, consolidation and checking across spreadsheets.

Instead, they can focus on more analysis and value-adding work – because the system simplifies their work.

The wider organisation also benefits, with access to more reliable and timely data that provide a timely representation of the organisation, and drives agile decision-making to deliver results.

Learn how Bevilles could model and plan scenarios quickly, and manage their retail business on a store level while giving management a better overview.

Learn how Tennis Australia achieved an integrated budgeting, forecasting and reporting solution and wider business goals with Workday Adaptive Planning.

Learn how Workday Adaptive Planning enabled Trilogy Funds to better manage their loans, forecast, report and make data-backed decisions.

Workday Adaptive Planning is highly rated by finance teams for its practical features which enable planning, budgeting, forecasting and reporting in a way that just makes better sense for finance teams. It lessens manual work and clunky spreadsheets, and empowers your team to focus on analysis and strategy instead.

Workday Adaptive Planning also empowers the wider organisation to understand and manage performance as a whole, and drive data based decisions that lead to more successful business outcomes.

What can Workday Adaptive Planning do? Its features include:

It has been a struggle for organisations to retain talent in a constantly changing marketplace. But people are core to every business, and we need the right people in the right place at the right time.

With proper workforce planning that integrates HR, finance and operations, your organisation can achieve its strategic goals and deliver results.

What are best practices in workforce planning? How can we plan in a way that sets us up for success now and in the future?

What are the benefits of Workforce Planning?

A solution is never bought alone – it must often be considered in relation to others in the organisation’s digital ecosystem. When software is integrated, interoperability is enhanced, allowing systems and applications to work together.

A key strength of Workday Adaptive Planning is it can seamlessly integrate with multiple data sources including ERP, CRM, GL and other data warehouses. These include Microsoft Dynamics, NetSuite, Pronto, Xero and more.

What are the benefits of software integration? When data flows automatically between your systems, you can:

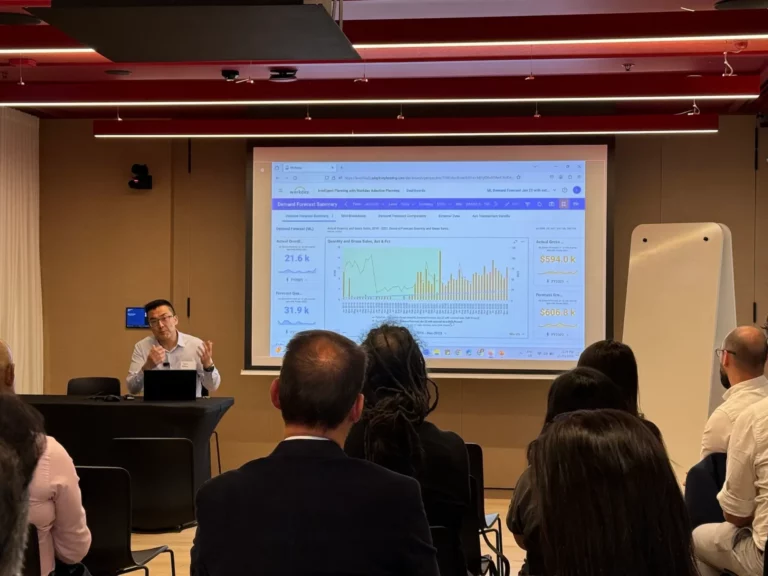

QMetrix organises webinars and events, and participates in other events, to share how organisations can benefit from corporate performance management solutions.

What you can expect from QMetrix webinars and events (varies based on event):

On 21st March 2024, QMetrix’s Workday Adaptive Planning team hosted an exclusive event for our Premium Care clients.

Join us for this webinar as we discuss how rolling forecasts can empower your finance team to navigate the business landscape and drive business growth, and share best practices on how to get it done well.

Finance leaders, join these free webinars hosted by FP&A experts who will share their experiences and best practices. These events are hosted by Adaptive Insights.

We’ve worked with businesses across Australia to do just that. Let’s chat about how it could work for your organisation too.

This website uses cookies to ensure you get the best experience on our website. More Information